history

From the Archives: A soldier’s duty to his family.

New York Life | November 15, 2023

Policy owner and Civil War officer sets in motion new standards for our company.

You would be hard-pressed to find a better example of the value of a New York Life policy as a hedge against an uncertain future — or a greater sign of the company’s commitment to ethical practices — than the case of John Foster.

New York Life policy owner and U.S. Army Captain John Gray Foster was stationed at Fort Sumter, S.C., in 1861 during what is considered the opening salvo of the Civil War. His experiences would lead to a poignant correspondence with New York Life about the war, Foster’s concerns for his family and the company’s patriotism.

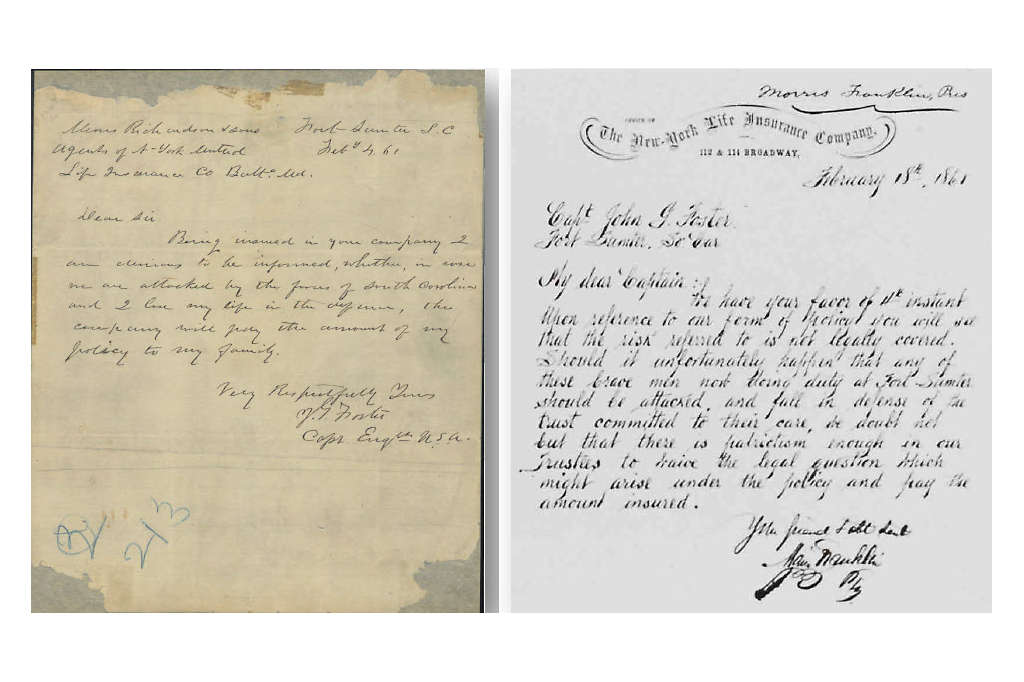

On February 4, 1861, about halfway through the standoff at Fort Sumter, Foster wrote to his New York Life agents. The letter reads:

Messrs Richardson & Sons

Agents of New York Mutual Life Insurance Co

Feb. 4, 61 [February 4, 1861]

Balto. [Baltimore], Md.

Dear Sir:

Being insured in your company I am desirous to be informed, whether, in case we are attacked by the forces of South Carolina and I lose my life in the defense, the company will pay the amount of my policy to my family.

Very Respectfully Yours,

J.G. Foster

Capt. Engrs [Engineers], U.S.A

New York Life President Morris Franklin answered Foster’s question personally two weeks later. His reply reads:

Morris Franklin, Pres

February 18th, 1861

My Dear Captain,

We have your favor of 4th instant. Upon reference to our form of policy you will see that the risk referred to is not legally covered. Should it unfortunately happen that any of these brave men now doing duty at Fort Sumter should be attacked, and fall in defense of the trust committed to their care, we doubt not that there is a patriotism enough in our Trustees to waive the legal question which might arise under the policy and pay the amount insured.

Your friend + [able servant?]

Morris Franklin

At the time, neither Franklin nor Foster knew that they were living through one of the most important moments of American history. They knew only that Foster faced the immediate prospect of combat over Fort Sumter and that New York Life was committed to doing the right thing, covering Foster’s family if he died in defense of the country. Fortunately, it did not prove necessary. Foster survived the events of Fort Sumter and served with great distinction throughout the entire Civil War. A career Army officer, he died a colonel and brevet (honorary) major general in 1874.

Soon after the correspondence with Foster, the company made clear its underwriting policies for war risks, one that did make provisions for Union soldiers who died in combat.

RELATED CONTENT

Go back to our newsroom to read more stories.