History

5 things to know about the founding of New York Life.

New York Life | April 21, 2020

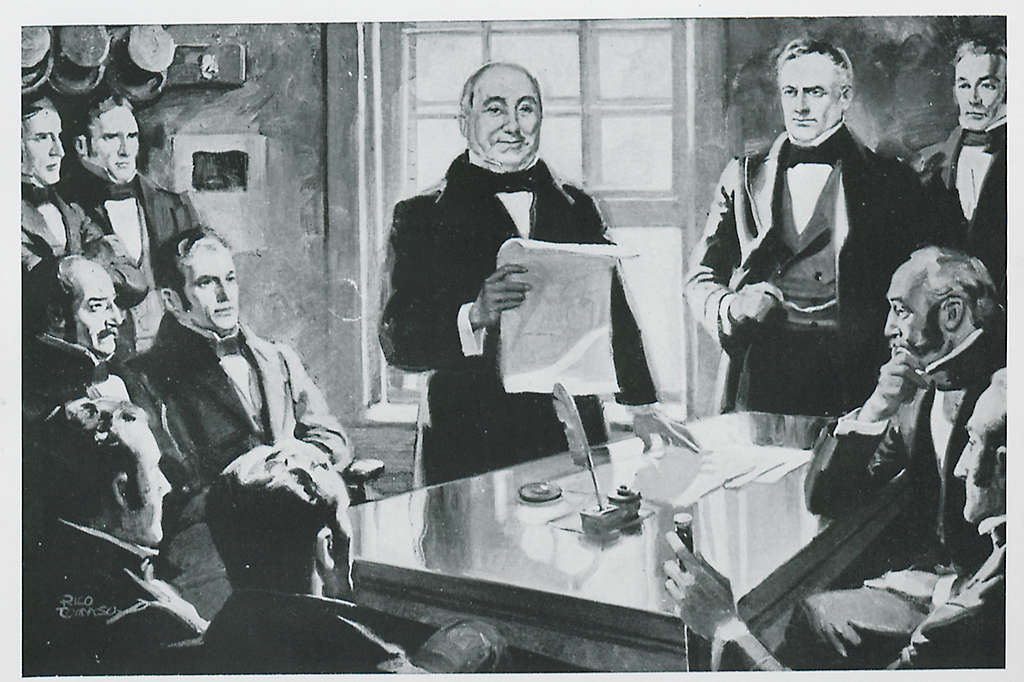

Step back a little over 178 years and you probably wouldn’t recognize New York Life. For starters, the company wasn’t yet called New York Life. New York Life was created at a time when mutuality was poised to disrupt the insurance industry. The company’s founders had recognized that disruption, embraced it for the benefits it offered to life policy owners, and built a successful business model around it all in the space of a few short years. Read on to learn more about the founding of New York Life.

- The Nautilus Insurance Company, our predecessor company, was established in 1841 and at first was a fire and marine insurance company.

- Nautilus initially operated as a joint stock organization. But it soon shifted gears as the concept of “mutuality” started gaining traction in the United States. The company found mutuality appealing due to the unique benefits it offered policy owners. In 1843, inspired by the success of a handful of startup mutual life insurers, Nautilus petitioned the New York State legislature to allow it to organize as a mutual company and sell life insurance, provided they received applications for life insurance amounting to $300,000.

- Nautilus reached this goal in two years, and on April 12, 1845, the company formed a board of trustees comprised of what one historian called “some of the most influential merchants and ‘captains of industry’ in the City of New York.” This is the date officially considered New York Life’s birthday.

- In June 1846, Nautilus answered its calling as a mutual life insurance company and ceded its marine business to other companies. By the following March, it had issued 1,000 policies.

- On April 5, 1849, Nautilus once again petitioned the New York State legislature to make yet another change—this time to its name. From that point on, the company became known as the New York Life Insurance Company.

RELATED CONTENT

Go back to our newsroom to read more stories.

Media contact

Kevin Maher

New York Life Insurance Company

(212) 576-7937

Kevin_B_Maher@newyorklife.com