HISTORY

Innovating from inception: A history of our first non-forfeiture policy.

New York Life | November 6, 2024

On August 13, 1860, 15 years after its founding, New York Life made insurance history when it issued policy number 14,415 on the life of William Harrison Sigourney for $1,000. This was the first non-forfeiture policy issued by an American life insurance company.

It was several years in the making, yet with that stroke of the pen, New York Life fundamentally changed the industry by putting policy owners’ needs first. Prior to this moment, those who missed premium payments resulting in cancelled policies had no way of getting any of their money back. Years of payments could disappear with no compensation.

In the 1850s, life insurance companies, lawmakers, and regulators began talking about creating non-forfeiture clauses to protect policy owners who couldn’t pay their premiums from losing their entire investment. Under these clauses, policy owners would receive either cash or benefits pro-rated for the payments they already made. At the time, most in the industry didn’t have the desire or ability to develop payments structures that offered fair compensation without hurting other policy owners.

During the May 1860 Life Underwriters’ Convention, several companies felt these clauses would create too many problems to be worth considering. But New York Life had been working on a plan, developed by actuary Rufus W. Weeks. The board adopted the plan on June 13, 1860, showing the industry it could be done.

After that first policy issued, non-forfeiture clauses gained in popularity. They turned out to be both fair to policy owners and profitable for the company, which retained its customers. The industry quickly followed New York Life’s example, and other companies introduced their own non-forfeiture clauses after seeing their success. Several states began to make these provisions mandatory, with Massachusetts passing the first such law in 1861.

The non-forfeiture clause is now standard industry practice thanks to the innovation of a young New York Life Insurance Company in the 1850s. We were able to innovate due to our strong risk assessment capabilities and leadership team. New York Life, then and now, continues to revolutionize the insurance industry by putting policy owners first and creating products that benefit both them and the company.

This article was originally published July 17, 2020.

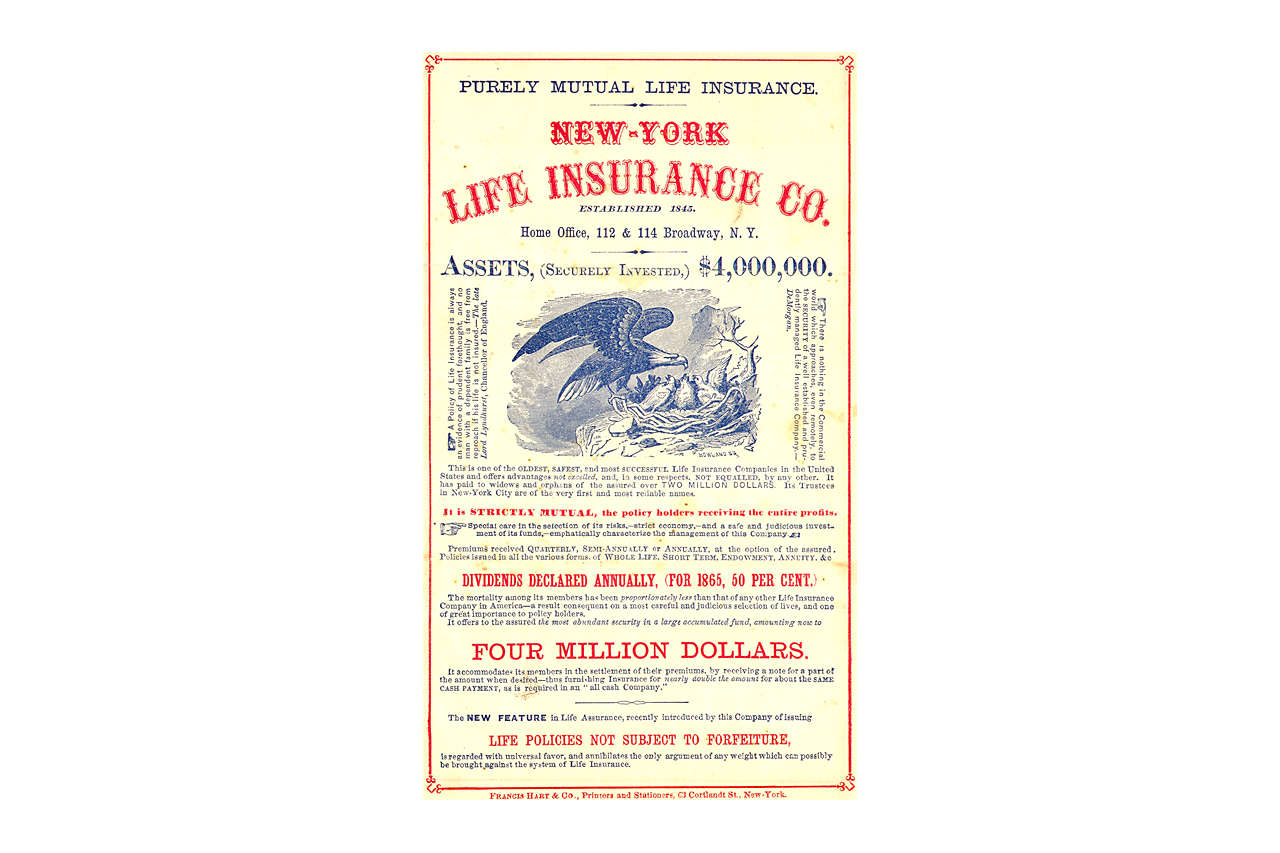

Pictured above: A New York Life ad from 1865 touts the company’s financial strength and states “Life policies not subject to forfeiture.”

RELATED CONTENT

Go back to our newsroom to read more stories.

Media contact

Kevin Maher

New York Life Insurance Company

(212) 576-7937

Kevin_B_Maher@newyorklife.com