Level of confidence about the ability to:

PERSONAL FINANCE

The caregiving crunch: Getting to know the women of the Sandwich Generation.

New York Life | November 24, 2020

Millennial women have a lot on their plates – especially now. In research recently conducted by New York Life, the evolving nature of the Sandwich Generation highlights how this population is changing and evolving as a result of the novel coronavirus. The data outlines a growing financial crunch being placed on Americans, with much of it being experienced by Millennial women.

Navigating family and finances

The research found that when thinking about the COVID-19 environment, women are less likely than men to feel confident about their financial strategy (39 percent of women feel confident compared to 50 percent of men.) Because of this, women are 55 percent more likely to place a higher priority on their finances compared to 49 percent of men when it comes to prioritizing finances due to COVID-19.

The report finds that, in the coronavirus environment, women in particular are thinking more about their kids – 54 percent of women compared to 41 percent of men – and their aging relatives – 66 percent of women compared to 61 percent of men — but they feel less confident about their ability to navigate other financial demands:

|

29% |

36% |

|

|

38% |

50% |

|

|

54% |

61% |

This data indicates that women in the Sandwich Generation are giving their time and effort to others before themselves, and are being crunched for resources in a way that may be creating financial obstacles.

Striking a balance – protecting your financial health while caring for your loved ones

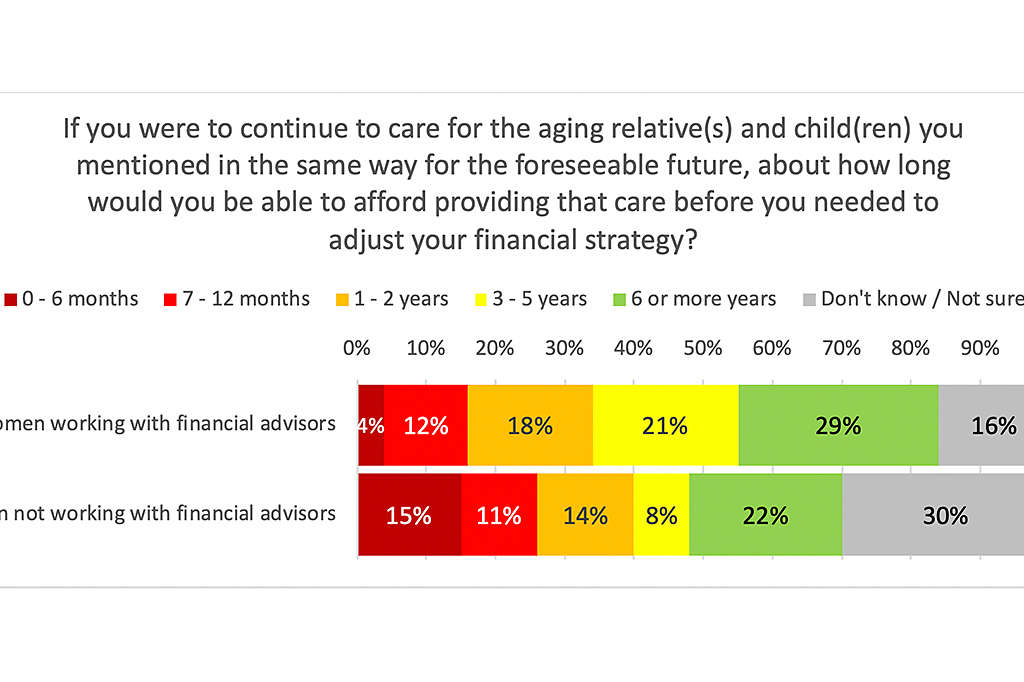

As families navigate new dynamics and caregiving demands, the data found that women who work with financial professionals are nearly twice as likely to feel their financial strategy will help them better afford to provide three or more years of care to their older relatives and children before they need to adjust their financial strategy; 50 percent of women working with financial professionals feel this way, compared to 30 percent of women not working with financial professionals.

In a time of virtual learning, additional precautions for older Americans, and a new idea of a “normal” day-to-day routine, having a trusted partner to help with your finances can be empowering. The basics ring true during both times of growth and times of uncertainty; having life insurance coverage, a well-established emergency fund, a properly diversified investment portfolio within your risk tolerance, and participation in company-sponsored retirement solutions to receive any available employer match, are all vital elements of a protection-first financial strategy. As one anticipates being a caregiver for the next few years, take a step back to review and adjust your portfolio and strategy as needed.

With support navigating the current economic environment, women in the Sandwich Generation can feel more confident in their ability to provide care for the near and longer-term.

There are non-financial benefits to fine-tuning or establishing a financial strategy as well. Overall, Americans prepared to provide care for six or more years are more likely to say they have more time to spend with their loved ones (62 percent of people surveyed) and on rest and relaxation (38 percent of people surveyed), even while providing care during the COVID-19 pandemic.

The women who help make up the Sandwich Generation are experiencing pressures from several different areas in their lives every day. Having a trusted financial professional to help them feel empowered by their financial strategy instead of overwhelmed by it, and confident that they are able to take care of themselves and their loved ones without additional stress can help them stay focused on the many ways they act on their love to keep their families safe and well.

RELATED CONTENT

Go back to our newsroom to read more stories.

Media contact

Sara Sefcovic

New York Life Insurance Company

(212) 576-4499

Sara_M_Sefcovic@newyorklife.com