HISTORY

Moments that mattered: 10 key milestones in New York Life’s history.

New York Life | January 24, 2025

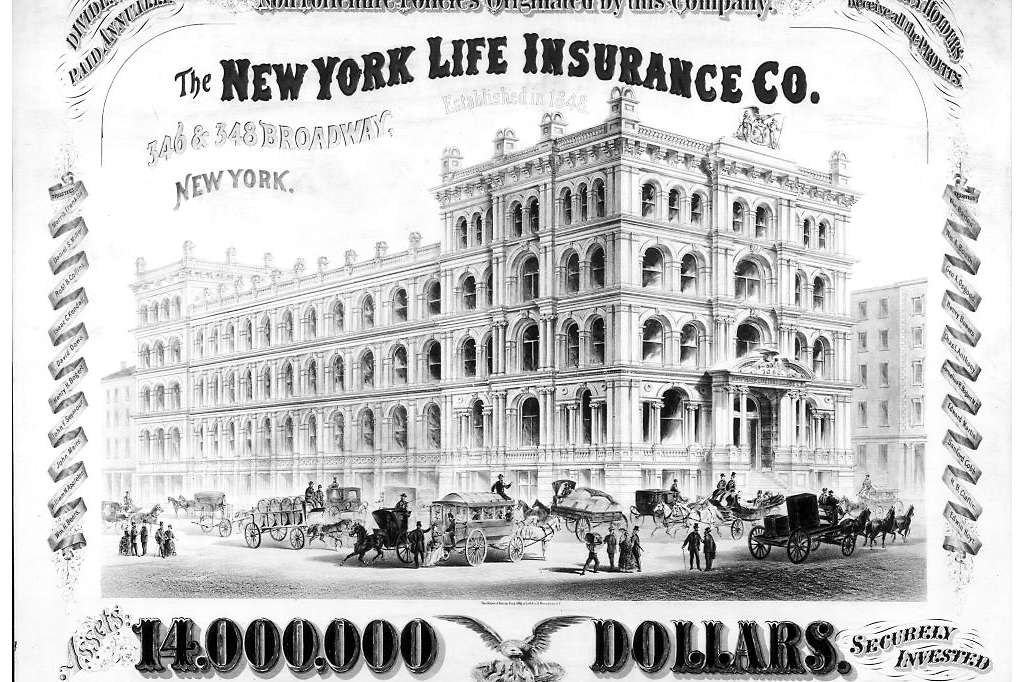

Entering new markets, launching products and services in new spaces, and more – here are some of New York Life’s top transformative business events since the company’s founding as The Nautilus Insurance Company in 1845.

1846 (June)

The Nautilus Insurance Company ceded its business in fire and marine insurance to other companies to enable its exclusive focus on life insurance. It would only take a few years for the revamped life insurance company to hit its stride and establish itself as an industry leader. In 1849, Nautilus’ board of trustees voted to change the company’s name to New York Life Insurance Company to reflect this shift from fire and marine to life insurance.

1860 (August)

New York Life changed the American life insurance industry by introducing the first American policy to contain a non-forfeiture clause. Policy 14,415 was issued on the life of William Harrison Sigourney for $1,000 and contained a provision that in the event of a missed payment, the policy owner was entitled to a prorated benefit or refund instead of simply losing all the money invested in premiums up to that point. At the time, most insurers opposed such a measure because of the expense involved, but New York Life embraced the practice.

1872

New York Life issued its first Tontine Investment Policy, in which policy owners agreed to pay their life insurance premiums into a tontine fund for a set number of years. During the tontine period, the fund grew and matured. At the end of the tontine period, policy owners who had kept up their payments would all be entitled to a share of the total proceeds. At a time when there was virtually no social safety net and retirement was largely left up to individuals, tontines provided a vehicle for long-term financial security.

1892

New York Life introduced an accumulation policy which did not place prohibitions on the insured’s occupation, residence, travel, or manner of death. Previous insurance policies had carried numerous clauses and restrictions for specific circumstances that could make it hard for people to understand their coverage or obey their proscriptions. The accumulation policy required some policy owners to pay higher premiums based on their circumstances, but they only needed to stay current on payments to maintain coverage. These policies made life insurance more accessible to the masses.

1952-’54

New York Life began work on a total redesign of its products and pricing, referred to internally by the codename “Project 25.” At the time work began, the company was still using mortality tables based on information gathered in the 1860s and premium rates had not been updated in 40 years. Project 25 drew on top company leadership and advances in early computer technology to rebuild products from the ground up. The new products were released in 1954. The new actuarial research allowed New York Life to offer policies ideally suited to modern times at much lower premiums than other insurers were charging for outdated products.

1984 (January)

New York Life purchased MacKay-Shields Financial Corporation, an investment management firm that would continue to operate as an independent subsidiary. MacKay-Shields enhanced New York Life’s position in the pension fund market and would be crucial to New York Life’s entry into mutual funds. In May 1986, the company developed a proprietary line of mutual funds, MainStay, that it distributed through its MacKay-Shields subsidiary. The proprietary line would be a tremendous success for New York Life, reaching $1 billion in assets by 1989. These offerings allowed New York Life to remain competitive in the fierce investment market of the 1980s while still offering financially stable products.

1999 (January)

New York Life’s board of directors voted to keep New York Life a mutual company after considering a range of options, including demutualization. At the time, many other insurers demutualized so they could sell stock and invest the proceeds in the booming securities markets. Then-Chairman, President & CEO Sy Sternberg explained New York Life’s decision not to follow suit: “We believe that the mutual structure … underscores our focus on policyholders and our long-term commitment to their needs. The primary responsibility of a mutual insurance company is to ensure that the long-term benefits promised to its policyholders are secure and protected.”

2000 (March)

New York Life’s asset management business was reorganized into a new $130 billion subsidiary: New York Life Investment Management LLC (NYLIM). The new subsidiary would hold most of the company’s assets under management in a single, focused organization. It would be composed of eight primary businesses: MainStay Management LLC; MacKay Shields LLC; Stable Value; New York Life Benefit Services LLC; Monitor Capital Advisors LLC; Madison Square Advisors LLC; and the Securities and Real Estate groups. Within three years, NYLIM would be one of the top investment management firms worldwide in institutional investments.

2011 (June)

New York Life launched the Guaranteed Future Income Annuity, a customizable retirement income product whose payments were guaranteed by the company. The product would prove even more successful than anticipated, leading to $100 million in premium payments in just three months, the strongest sales introduction of any new annuity product in the company’s history. It would later receive the first ever Award for Innovation in Retirement Income Products from the Retirement Income Industry Association.

2019 (December)

New York Life and Cigna announced they had reached an agreement for New York Life to acquire Cigna’s group life and disability insurance business for $6.3 billion. The acquisition – the largest in New York Life’s history – was completed in December 2020 and added over 9 million customers to New York Life. The acquisition of what would be renamed New York Life Group Benefit Solutions instantly made New York Life a top five insurer in group life, accident and disability insurance.

RELATED CONTENT

Go back to our newsroom to read more stories.

Media contact

Kevin Maher

New York Life Insurance Company

(212) 576-7937

Kevin_B_Maher@newyorklife.com