Up to 85% of your benefits may be taxable, but it depends on your income and filing status. To find out for sure, visit the IRS website.

Planning a tax-efficient retirement

Plan for your retirement by investing in tax-advantaged accounts and by using efficient withdrawal strategies.

Is retirement income taxable?

If you’re starting to plan for retirement, you might be surprised to learn that most of the income you receive will be taxed. The good news is that not all sources of income are taxed the same way. With the right tools and withdrawal strategies, you can reduce the impact taxes will have on your financial security.

How retirement benefits and other sources of income are taxed

As you look ahead, it’s important to understand how all your income will be taxed. Here’s a quick look at some common sources of retirement income and their tax treatment:

- Social Security payments may be partially taxable if your total income crosses certain thresholds. In some cases, 50% to 85% of your benefit could be subject to federal income taxes.

- Pension payments are generally taxed as ordinary income—much like a paycheck. Since the benefit is provided by your employer, there are no special tax breaks.

- Withdrawals from traditional 401(k)s and IRAs are fully taxable in the year you take them. Roth accounts, by contrast, are tax-free in retirement because you already paid taxes upfront.

- Interest from bonds is treated differently depending on the type. Municipal bond interest is federally tax-free, while U.S. savings bonds allow you to defer federal taxes until you cash them in.

- Income annuities are taxed based on how they were funded: pre-tax contributions make them fully taxable in retirement, while after-tax contributions mean only part of the income (your growth) is taxed.

- Withdrawals from brokerage accounts are taxed as ordinary income unless the proceeds come from an asset you owned for more than a year. Assets held longer are taxed at the capital gains rate, which is often much lower (0%, 15% or 20%, depending on your tax bracket).

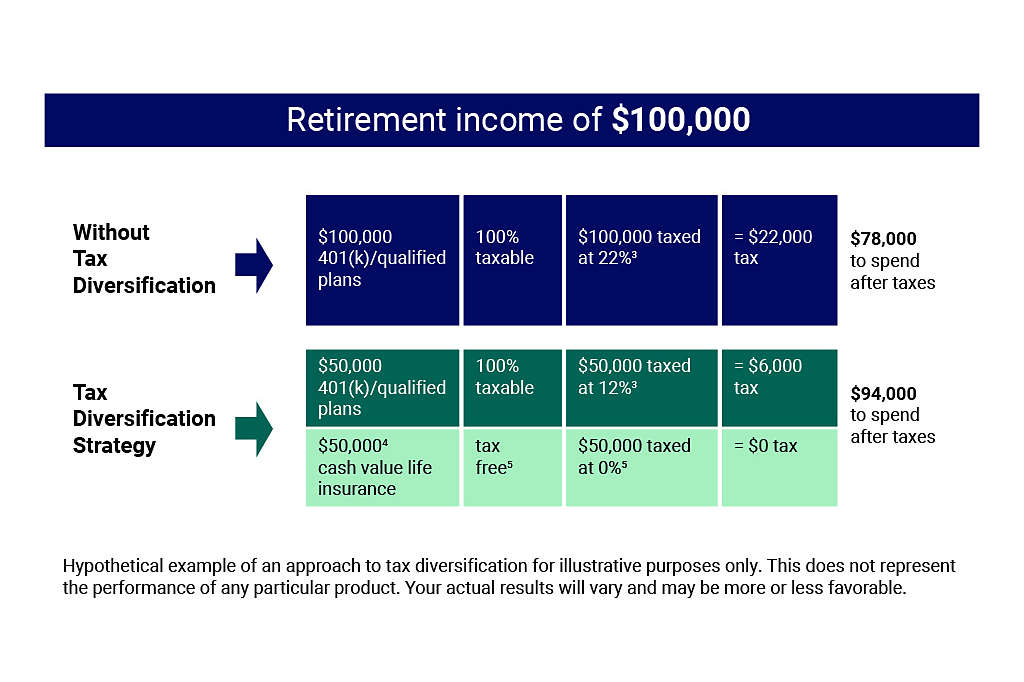

Diversifying your income can be a smart withdrawal strategy

One of the best ways to minimize taxes in retirement is to diversify your assets so that you can access each one when it is most advantageous. Here’s one of the most common ways to go about it.

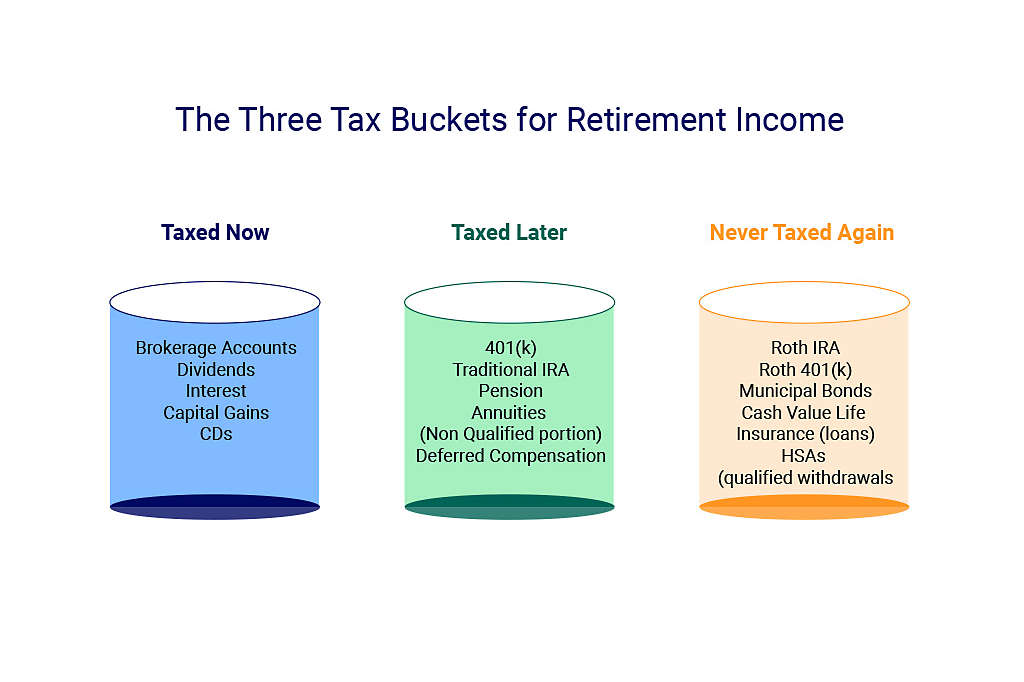

The three bucket system

The three-bucket system is a way to make sure that all your retirement income does not become taxable at the same time and force you into a higher tax bracket. It works by distributing all your income generating assets into three distinct categories (or buckets):

- Taxed Now – These are accounts where taxes are taken out each year. This applies to bank accounts that earn interest and brokerage accounts that generate dividends, interest income, or capital gains.

- Taxed Later – These are tax-deferred accounts such as traditional IRAs and 401(k)s. You avoid taxes while you’re saving, but you’ll owe ordinary income tax when you withdraw money in retirement. Pensions and qualified annuities also fall here.

- Never Taxed Again – These are accounts like Roth IRAs, Roth 401(k)s, and Health Savings Accounts (for qualified healthcare costs). You pay tax upfront on contributions, but growth and withdrawals in retirement are tax-free. Municipal bonds can also fit here since the interest they generate is exempt from federal taxes.

Why is tax-diversification helpful?

When it comes to taxes, timing is everything. A single large withdrawal from a traditional IRA can push you into a higher tax bracket, increase the amount of your Social Security benefits that are taxed, and even affect Medicare premiums.

Having money spread across all three tax buckets gives you flexibility and control in retirement. It allows you to choose which accounts to draw from depending on your tax situation at the time. For instance, if your income is unusually high and you want to avoid moving into a higher tax bracket, you could take extra funds from your tax-free Roth account. On the other hand, if your income is lower than usual, it might be the perfect opportunity to withdraw money from a 401(k) or other tax-deferred account since the additional income will be less likely to affect your tax bracket. This strategy helps you manage both taxes and income more efficiently throughout retirement.

Related: Types of Retirement Plans

Does life insurance help with tax-diversification?

As you may have noticed, cash value life insurance was listed in the “never-taxed again” bucket above. If you no longer need the full death benefit, you can use the cash value of your permanent life insurance policy to help fund your retirement. Since withdrawals are tax-free in most cases, this approach can reduce your tax obligations and help you keep more of your money.1

Watch out for RMDs

Required Minimum Distributions (RMDs) are mandatory withdrawals that you must begin taking from tax-deferred retirement accounts—such as traditional IRAs and 401(k)s—at a specific age (73 for most people). Because these withdrawals are taxed as ordinary income, they can significantly increase taxable income in retirement, potentially pushing you into higher tax brackets. A tax diversification strategy can reduce the impact RMDs can have by spreading distributions over a longer period.

Deductions and other ways to reduce taxes in retirement

Another way to reduce your tax burden is to make sure you capitalize on all the latest tax breaks available for retirees. Here are just a few that you will want to incorporate into your planning:

Extra standard deductions for older adults

If you’re 65 or older, you qualify for an extra amount added to your regular standard deduction. Single or head of household filers can claim an additional $1,950. Married couples filing jointly can add up to $3,100 if both spouses are 65 or older. This is a permanent feature of the tax code and can be applied every year.

New bonus deductions for seniors

Starting in 2025, there is also a new “bonus” deduction specifically for older adults. Seniors 65 and older can claim an extra $6,000 deduction, or $12,000 if both spouses are eligible and file jointly. This deduction is in addition to the standard deduction as well as the extra standard deduction above. However, it begins to phase out once your Modified Adjusted Gross Income (MAGI) exceeds certain thresholds, and unless extended by Congress, it will expire after 2028. 2

The best thing about these deductions is that they are stackable. When combined with the standard deduction, they can dramatically reduce your taxable income—and possibly offset any taxes you may have to pay on Social Security.

Deductible Medicare premiums

If you itemize your deductions and your total medical expenses exceed 7.5% of your Adjusted Gross Income (AGI) you can deduct your Medicare Part B, Part D, and Medicare Advantage premiums. (You do not have to meet the AGI threshold if you are self-employed in retirement and do not have access to other coverage.)3

Deductions for charitable contributions

Up to $100,000 can be transferred each year to a charity from an IRA or a 401(k) after age 70 ½.4 No taxes will be owed on that money, and the contribution will count as a required minimum distribution.

State and local deductions

Many states offer specific state tax benefits to seniors, and some do not tax Social Security earnings. Be sure to check with a local tax expert to see what’s available in your state—or in the state you may relocate to in retirement.

Get the information you need to retire with confidence

Planning for tax-efficient income in retirement is not something you have to do alone. By diversifying your accounts, making the most of tax breaks, and using smart withdrawal strategies, you can create flexibility and help protect more of your income. A financial professional can guide you through the complexities, tailor strategies to your specific situation, and help you avoid costly mistakes. With the right plan—and the right guidance—you can enjoy retirement with greater confidence and peace of mind.

Planning a tax-efficient retirement FAQs

In most cases yes, pensions are taxed as ordinary income. The only exception is if you contributed to your pension and then a portion of the income you receive will be tax free.

While these accounts offer a host of tax benefits upfront, withdrawals are taxed as ordinary income.

Many people assume their taxes will automatically go down in retirement, but that’s not always true. Required minimum distributions, Social Security, and even part-time work can combine to push you into a higher income bracket than expected—especially if you’ve done a good job saving for retirement. That’s why it’s so important to work with a financial professional and make sure that you have a well-thought-out withdrawal strategy in place.

Tax-free means the earnings or withdrawals are never taxed, such as with a Roth IRA where qualified withdrawals are completely free of income tax. Tax-deferred means you postpone taxes until a later date, such as with a traditional IRA or 401(k), where contributions and growth are untaxed but withdrawals are taxed as ordinary income.

Pre-tax accounts let you contribute money before income taxes are taken out, reducing your taxable income now, but withdrawals in retirement are taxed. After-tax accounts use money you’ve already paid taxes on, so your contributions don’t reduce your taxable income now, but qualified withdrawals are tax-free.

Want to learn more about financial strategies for retirement?

A NYLIFE Securities Registered Representative can help determine what’s right for you.

Related CONTENT

Make sure it's secure with our retirement products and solutions.

Thank you for subscribing!

1The primary purpose of life insurance is to provide a life insurance benefit. Loans and withdrawals reduce the death benefit, surrender value, and available cash value of the policy.

2 “One, Big, Beautiful Bill Act: Tax deductions for working Americans and seniors,” IRS.gov, July 14, 2025

3 2024 Instructions for Schedule A,” IRS.gov

4 “Qualified charitable distributions allow eligible IRA owners up to $100,000 in tax-free gifts to charity,” IRS.gov, November 16, 2023 (updated May 28, 2025

Investments are offered through NYLIFE Securities LLC (member FINRA/SIPC), a Licensed Insurance Agency and a New York Life company.

This material is for informational purposes only. Neither New York Life nor its agents provide tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions.