Annuities, once they are in the payment phase, typically pay out in predetermined intervals such as every month or every quarter.

Present vs. future value of an annuity

A bird in the hand is worth two in the bush. This old adage can also apply to your finances. Receiving $100 today is better than receiving $100 next year. That is pretty clear. But is getting $100 today better than $120 next year? That’s a more difficult comparison. The present and future value of annuities are ways to calculate and more easily compare how money today compares to money in the future.

What is an annuity?

An annuity is an insurance contract that provides a steady stream of income over a set number of years, or for the rest of your life. You can purchase annuities with a lump-sum premium or a series of monthly premiums that add up over time. Annuities are often sold by insurance companies as a tool for retirement planning and can offer a reliable source of income. They come in various forms, each designed to meet different financial needs.

Lifetime income annuities

A lifetime income annuity provides guaranteed payments for your entire life. Once it’s purchased, you’ll receive regular and reliable payments for as long as you live regardless of how long that may be. That makes lifetime income annuities particularly attractive for retirees seeking a secure and predictable income during retirement. There are two main types of lifetime income annuities:

Immediate income annuities are funded with one lump-sum payment (premium) in exchange for lifetime payments. The initial payment can come from after tax dollars or from a portion of a qualified retirement savings account like a 401(k) or IRA, and the larger that payment, the more you’ll receive back each period. Lifetime income annuities are a way to guarantee stability in retirement by taking the guesswork out of how much you can spend each month.

Deferred income annuities are purchased earlier in life and can be funded with a series of premium payments over a long period or one time. This makes it a useful solution for someone in their prime earning years as a way to supplement other retirement savings.

Read more about how annuity payouts work

Fixed period annuities

Unlike a lifetime income annuity, which continues payments for life, a period annuity has a predetermined duration, after which the payments cease. This form is common with injury settlements and lottery payouts. Another savings option are fixed deferred annuities, which offer a guaranteed growth rate and tax advantages while avoiding potential market risks. This makes them a low-risk way to save long term.1

You can only calculate value for fixed-period annuities

Since the period involved is integral to the calculation of the present and future value of an annuity, it is impossible to calculate these values accurately for a lifetime income annuity. You can, however, make some estimates. You can calculate the values for different durations (e.g., 10, 15, and 20 years) to get a sense of the value and how it will change over time, depending on your longevity.

Present value of an annuity

The present value of an annuity is a financial concept that represents the current value of a series of future payments. Because money now is considered worth more than money in the future, the present value is different than the total sum of all future payments. This is often referred to as the time value of money.

Understanding the present value of an annuity can help you with better decision-making, asset analysis, and retirement planning. Here are two common ways this calculation can be useful:

- If you are deciding between a lump-sum payment and a fixed-term annuity or structured settlement, present value can help you compare the two.

- If you know you need a certain amount of money each month from an annuity, you can calculate how much you’ll need to pay now.

Finding the present value of an annuity

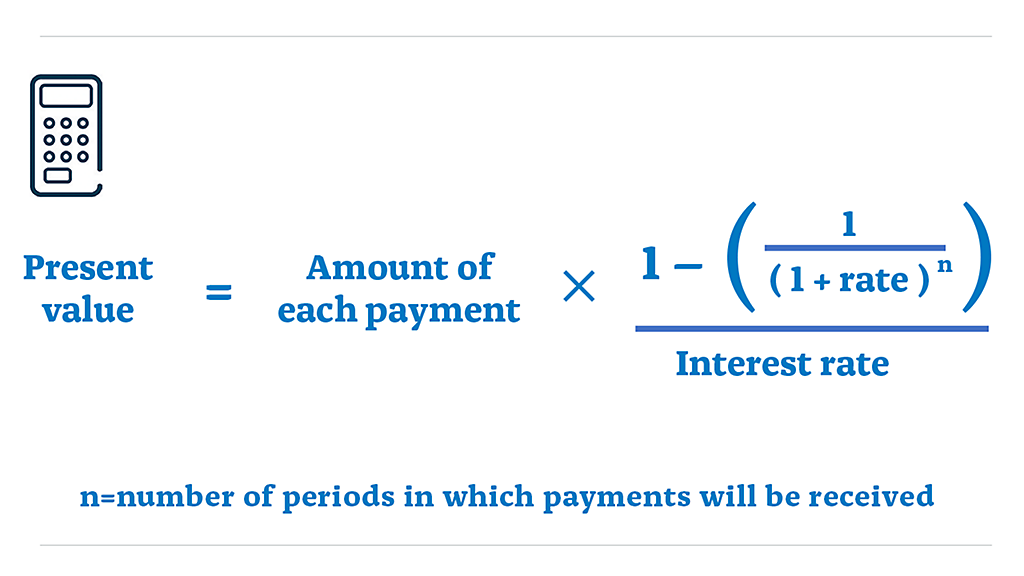

In order to find the present value of an annuity, you need to know a few variables: the exact amount of each payment to be made, the interest rate or discount rate, and the number of payments you will receive. Here is the calculation you would use to find the present value of an ordinary annuity:2

Present value annuity formula

Future value of an annuity

The future value of an annuity can help you calculate what an investment made today will add up to over the life of an annuity. This makes it basically the reverse of calculating current value. Figuring out the future value of an annuity can be helpful with investment and retirement planning.

Finding the future value of an annuity

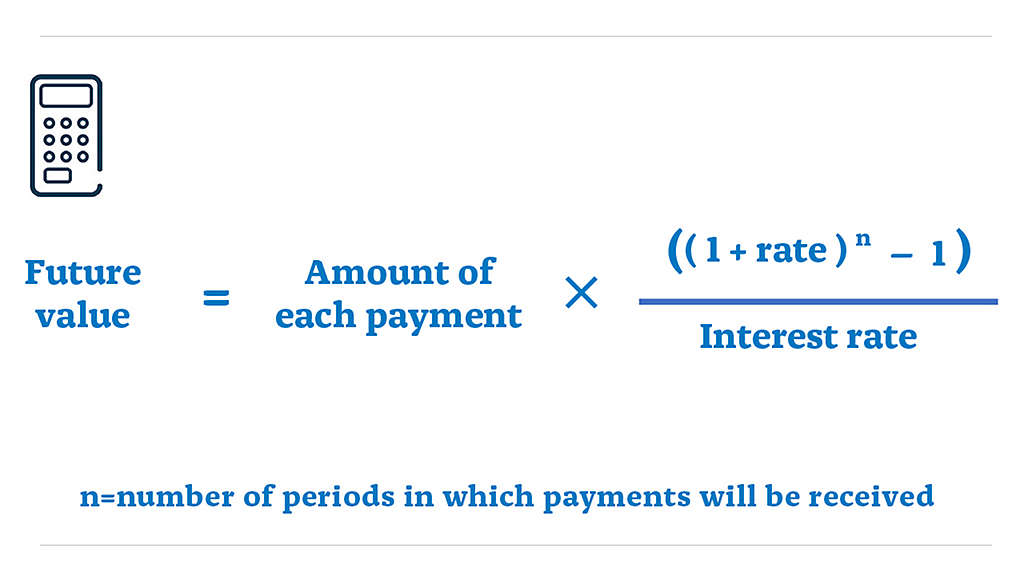

To calculate the future value of an annuity, we need the same pieces of information: the amount of each payment, the interest (or discount) rate, and the number of payment periods. The calculation is just a little bit different:

Future value annuity formula

Explore annuity options

Since there are so many options for annuities, the best approach to finding the perfect fit for your ideal retirement is to speak with a qualified financial professional. They can help you determine if an annuity makes sense based on your financial needs.

Present and future value of annuities FAQs

Annuities are guaranteed. As long as you understand the terms, they are one of the safest financial solutions available for retirement.

Annuities grow tax deferred, which means you don’t pay taxes on the money you gain every year. However, when you start receiving payments, they are taxed as regular income.

The amount will vary based on your age, interest rate, term, and type of annuity, plus many other factors. Someone in their sixties might expect between $600 and $800 per month on a $100,000 immediate lifetime annuity.

The amount will vary based on your age, interest rate, term, and type of annuity, plus many other factors. Someone in their sixties might expect between $4,500 and $6,500 per month on a $1,000,000 immediate lifetime annuity.

RELATED CONTENT

Learn more about the value of guaranteed lifetime income.

1All guarantees are dependent upon the claims-paying ability of the issuer. Neither New York Life Insurance Company, nor its agents, provides tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions.

2“Present value of an Annuity: Formulas, Calculations & Examples,” Annuity.org, October 2023.