How does disability insurance work?

When you become disabled due to an injury or sickness, even if it happens outside of the workplace, your disability insurance benefits will start after a certain amount of time has elapsed. Read on for a thorough breakdown of how it works.

How long-term disability insurance benefits work

What happens when you get sick or have an injury that prevents you from doing your job? If you don’t have disability insurance, that is a difficult question to answer. How long could you manage without a paycheck? A few weeks? A few months? What if you were unable to work for a year or more? Most people would not be able to maintain their lifestyle.

That’s exactly what disability insurance covers, making sure you receive a portion of the income you’re used to, even if you can’t work. How much and how long depends on several factors, but here’s how most disability insurance works:

Securing coverage

Before you can collect benefits, you’ll need to have a disability insurance policy in place. Some employers offer disability insurance as a benefit, at zero cost or a subsidized rate. Often, this is short-term disability. If your application is approved, it pays disability benefits for anywhere from a few months to a year. But what happens if you are unable to work longer than that? Or if you lose the job that provided the insurance? Some employers provide group long-term disability insurance, but even that has limitations.

No matter what your situation, individual long-term disability insurance can be an answer to providing some income protection for you and your family. Unlike most employer-provided policies, it is transferable no matter where you work, and it can cover you more securely and for a longer period, so you can rest assured that your family’s future is protected should something happen to you.

Injury and sickness: What counts as disability?

When most people think of disability insurance, they picture a workplace accident that results in great bodily harm. While disability insurance does cover those rare occurrences, 90% of disability claims stem from sicknesses. And it’s needed far more often than you think.

25% of people will experience a disabling event at some point before retirement that will lead to missing work for a year or more.¹

Depending on your policy, some sickness and conditions may not be covered, but generally, long-term disability covers common things like:

- Cancer

- Diabetes

- Chronic pain

- Joint issues

- Depression

- And more

Related: What does disability insurance cover?

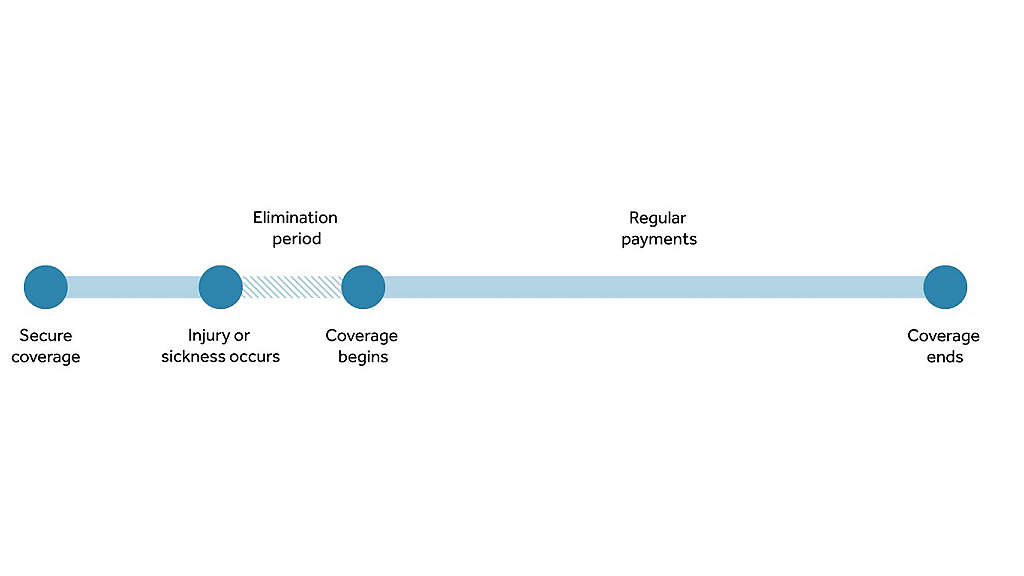

Elimination period

This is the total number of days you must be disabled before you can start collecting long-term disability insurance benefits. They don’t have to happen in consecutive order, but need to add up within a given period, called the accumulation period. Often, long-term disability insurance elimination periods coincide with the end of any short-term disability coverage you may have through your employer. The elimination period can be anywhere from a month to two years or more. Larger elimination periods will result in lower disability insurance premiums.

Length of coverage

Once the elimination period is over, your benefit payments will begin. Policies vary, but they generally cover 50% to 70% of your income for a set period. Short-term insurance sometimes covers only a few weeks to a few months, and it cannot be longer than two years. Since the average disability claim is for nearly three years2, this may not be enough. With individual long-term disability insurance, benefit payments can continue for five, 10, or 20 years, and can even cover you all the way until your retirement age. That allows it to protect a lot more of your future earning potential.

Related: Short-term vs. long-term disability

Recovery and return to work

Your coverage typically ends when you’re able to return to your normal capacity at work, or when the benefit length is reached. For some, this period may be as short as a few months, while others never fully recover. For those who never fully recover, long-term disability insurance can protect a part of their lifetime income potential. There are varying degrees of disability and partial coverage to take into account when you consider long-term disability policies.

An example of disability insurance

Sally is an engineer at an engineering consulting firm. She has short-term disability insurance through her employer, but she did not opt into the group long-term disability plan. Because she wanted career flexibility, she instead chose to purchase an individual long-term disability policy with a benefit period of five years.

Unfortunately, she is diagnosed with cancer. Her doctors recommend beginning treatment right away, and the program she’ll go through will prevent her from doing her normal job. Luckily, since she has both short-term and long-term protection, she doesn’t need to worry about where her next paycheck will come from when she starts treatment. Her employer-provided policy covers her for six months and pays 60% of her normal salary. That’s enough to get by and keep up with her mortgage and bills.

After six months, Sally is still undergoing treatment, but her prognosis is good. The elimination period on her long-term disability policy is designed to end when her employer-provided plan stops, so Sally has no gaps in her benefit payments. Sally opted to have her long-term plan cover a larger portion of her income: 75%. Her monthly payments increase, and in addition to covering her expenses, she’s able to save a little. She receives regular payments as she continues her battle with cancer. Finally, two years after her initial diagnosis, Sally is cancer-free and fully recovered. She is ready to return to work, and she feels grateful that she’s now healthy and that she has been financially able to support herself and her family during a difficult time.

Why is long-term disability insurance important?

We insure our homes. We insure our cars. Many realize too late that our ability to earn an income is the most valuable asset most of us possess. Protecting our income is an essential part of every financial strategy. To understand how important it could be to you, calculate your earnings for the next year, for the next five years, and for the next 20 years. That’s your earning potential, and it is at risk of being lost. Disability insurance will help ensure that you and your family will be provided for, even if you can’t work.

Related Resources

See what options best fit your needs for disability insurance.

A dedicated professional with New York Life can help you find the best policy.

1 Social Security Administration, 2021: https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

2 “Are You Underestimating Your Need for Disability Insurance?,” Kiplinger, September 9, 2020.